Hey there, investors! If you've been keeping an eye on the market lately, you've probably noticed how volatile things have been. But let me tell ya, amidst all the chaos, UPS stock stands out like a beacon of stability. Whether you're a seasoned investor or just dipping your toes into the world of stocks, this one deserves your attention. So grab a cup of coffee, sit back, and let’s dive into why UPS stock might be the golden ticket you've been looking for.

Now, before we get into the nitty-gritty, let's set the stage. UPS, or United Parcel Service, isn't just some random company that popped up overnight. It's a global logistics giant with a history that dates back over a century. Their stock, which trades under the ticker symbol UPS, has been a favorite among investors for years. But what makes it so special right now? Stick around, and we'll break it down for you.

One thing's for sure, when you're considering UPS stock, you're not just buying into a company; you're investing in a brand that's synonymous with reliability, innovation, and growth. So, whether you're looking for long-term gains or short-term opportunities, this stock could be your ticket to success. Let's jump into the details, shall we?

Read also:Court Statement To Family Killer Unveiling The Truth Behind Justice And Closure

Table of Contents

- Overview of UPS Stock

- A Brief Biography of UPS

- UPS Stock Market Performance

- Key Drivers of UPS Stock Growth

- Challenges Facing UPS Stock

- Future Prospects for UPS Stock

- Investment Strategy for UPS Stock

- Financial Highlights of UPS

- UPS Stock vs. Competitors

- Final Thoughts on UPS Stock

Overview of UPS Stock

Alright, let's start with the basics. UPS stock, as I mentioned earlier, is tied to one of the most iconic brands in the logistics and delivery space. But what exactly does this mean for you as an investor? Well, for starters, it means you're getting access to a company that's been around since 1907. Yep, you heard that right. Over a hundred years of delivering packages, building relationships, and adapting to the ever-changing world of commerce.

Why UPS Stock Matters Today

Here's the deal: in today's fast-paced world, where e-commerce is booming and consumers expect their packages yesterday, UPS is right there in the thick of it. Their ability to innovate, expand their services, and keep up with the demands of modern business is what makes their stock so appealing. Whether it's expanding their fleet of electric vehicles or investing in cutting-edge technology, UPS is always a step ahead.

And let’s not forget about the numbers. Over the past few years, UPS stock has consistently outperformed many of its competitors. Sure, there have been ups and downs, but the overall trend has been upward. And hey, isn't that what we're all looking for in a stock? Stability with the potential for growth? Yeah, thought so.

A Brief Biography of UPS

Let’s take a quick trip down memory lane to understand just how UPS became the powerhouse it is today. It all started back in 1907 when a young man named Jim Casey founded the company in Seattle, Washington. Back then, it was called the American Messenger Company, and it focused on delivering telegrams and packages by foot or bicycle. Fast forward a hundred years, and UPS is now a global leader in logistics, operating in over 220 countries and territories.

Key Milestones in UPS History

- 1919: The company expanded its services to include package delivery and changed its name to United Parcel Service.

- 1975: UPS went international, opening its first location outside the U.S. in Canada.

- 1999: UPS went public, listing its shares on the New York Stock Exchange under the ticker symbol UPS.

- 2023: With a focus on sustainability and innovation, UPS continues to lead the charge in the logistics industry.

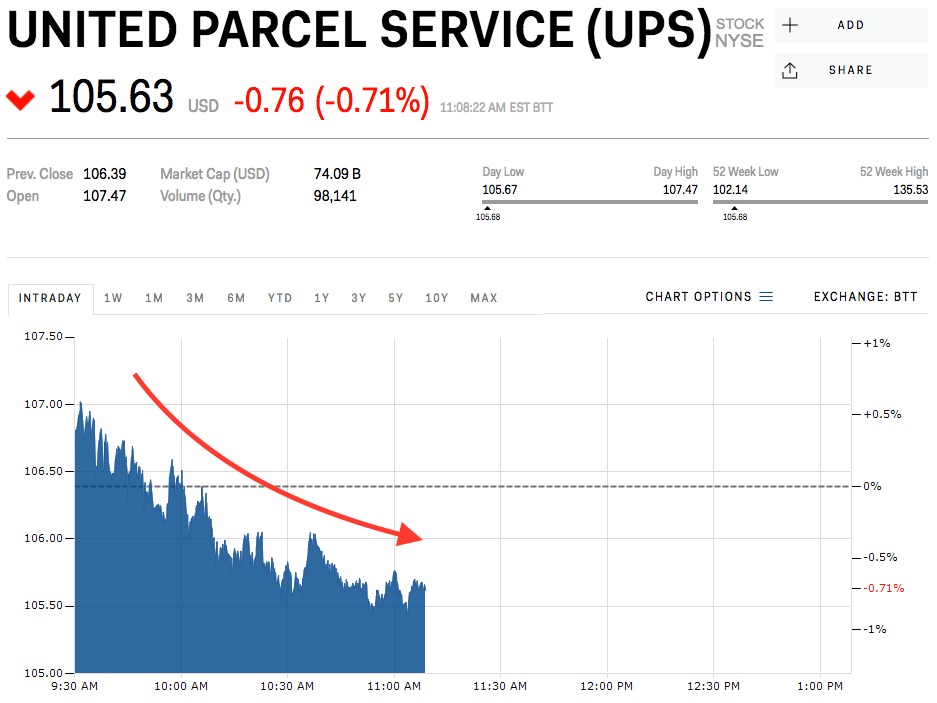

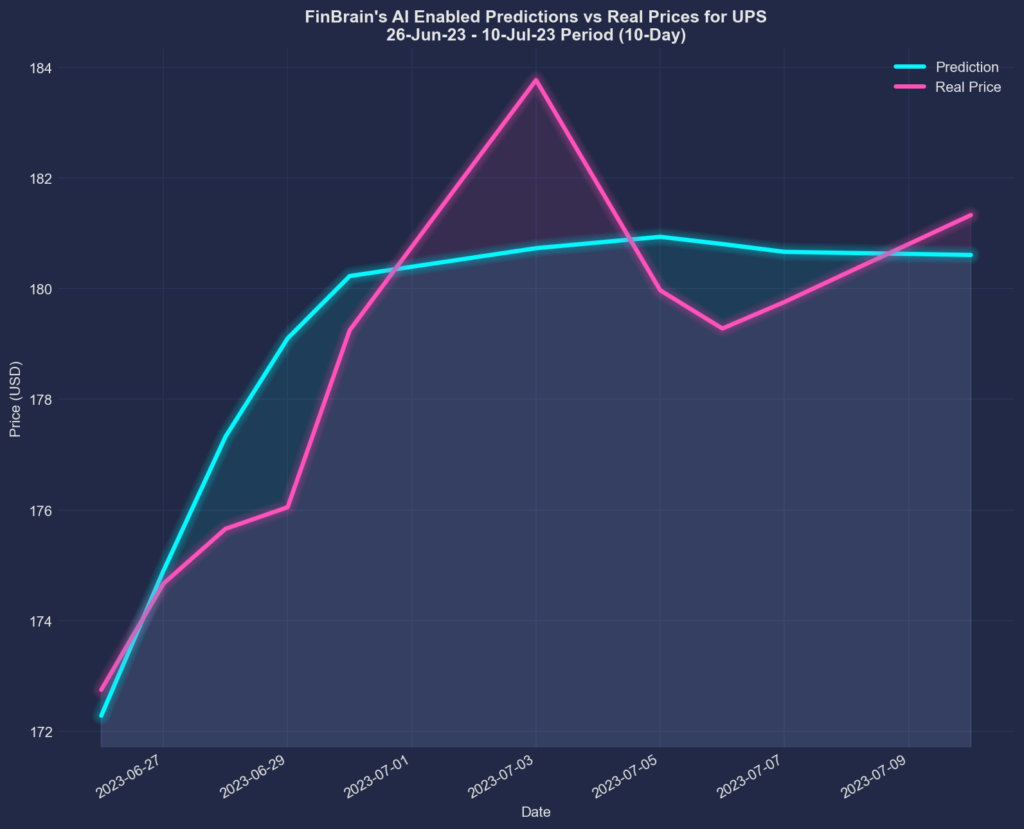

UPS Stock Market Performance

Now, let’s talk numbers. If you’ve been following the stock market, you know that performance is key. So, how has UPS stock been doing lately? Well, if you look at the charts, you'll see that it's been on a pretty solid run. Sure, like any stock, it's had its ups and downs, but overall, it's been a winner.

In the past five years, UPS stock has seen an average annual return of around 8%. Not bad, right? And if you dig a little deeper, you'll see that the company has been consistently increasing its dividends, which is always a good sign for investors. Plus, with a strong balance sheet and a solid earnings track record, UPS stock is a great option for those looking for both income and growth.

Read also:Raiders Safety Scores Big Bonus A Gamechanger In The Nfl Scene

Key Drivers of UPS Stock Growth

So, what’s driving the growth of UPS stock? Well, there are a few key factors at play here. First and foremost, the rise of e-commerce has been a major boon for UPS. As more and more people shop online, the demand for fast, reliable delivery has skyrocketed. And guess who's leading the charge in that department? That's right, UPS.

Factors Contributing to Growth

- E-commerce Boom: With online shopping continuing to grow, UPS is perfectly positioned to benefit.

- Sustainability Initiatives: UPS has made a big push towards sustainability, investing in electric vehicles and renewable energy.

- Global Expansion: By expanding into new markets, UPS is tapping into emerging economies and increasing its customer base.

Challenges Facing UPS Stock

Of course, no investment is without its challenges, and UPS stock is no exception. One of the biggest hurdles facing the company is competition. With giants like FedEx and DHL nipping at their heels, UPS has to stay on its toes to maintain its market share. Additionally, rising labor costs and regulatory pressures are always a concern.

But here's the thing: UPS has a history of overcoming challenges. Whether it's through innovation, strategic partnerships, or simply outworking the competition, they've proven time and again that they're up to the task. So, while these challenges are real, they're not insurmountable.

Future Prospects for UPS Stock

Looking ahead, the future looks bright for UPS stock. With the continued growth of e-commerce, a focus on sustainability, and a commitment to innovation, UPS is well-positioned for success. And let’s not forget about their strong financials and solid management team. These are all factors that make UPS stock a compelling investment opportunity.

What to Expect in the Next Few Years

- Further expansion into international markets.

- Increased investment in technology and automation.

- Continued focus on sustainability and reducing carbon emissions.

Investment Strategy for UPS Stock

So, you're convinced that UPS stock is worth a look, but how do you go about investing in it? Well, it all depends on your goals and risk tolerance. If you're looking for long-term growth, consider buying and holding the stock. If you're more of a short-term trader, you might want to look at options or other derivatives.

Whatever strategy you choose, make sure you do your homework. Keep an eye on earnings reports, industry trends, and any news that might impact the company. And remember, diversification is key. Don't put all your eggs in one basket, no matter how good the stock looks.

Financial Highlights of UPS

Let’s take a quick look at some of the financial highlights of UPS. In the most recent quarter, the company reported revenue of $28.1 billion, up 7% from the previous year. Net income came in at $2.8 billion, with earnings per share of $3.26. These numbers are impressive, especially when you consider the challenges the company has faced in recent years.

And let’s not forget about the balance sheet. UPS has a strong cash position and a manageable debt load, which gives them the flexibility to invest in growth opportunities. Plus, their dividend yield is currently around 3%, which is pretty attractive in today's low-interest-rate environment.

UPS Stock vs. Competitors

Now, let’s compare UPS stock to some of its competitors. When you look at FedEx and DHL, you'll see that UPS holds its own quite well. While all three companies are leaders in the logistics space, UPS has a few key advantages. First, they have a stronger brand presence, which translates to customer loyalty. Second, their focus on sustainability is unmatched, which is increasingly important to consumers and investors alike.

And let’s not forget about their financials. While all three companies have solid balance sheets, UPS has consistently delivered better returns to shareholders. So, if you're looking for a logistics stock to add to your portfolio, UPS is definitely worth considering.

Final Thoughts on UPS Stock

Well, there you have it, folks. UPS stock is a solid investment opportunity with a lot of potential. Whether you're a long-term investor or a short-term trader, there's something here for everyone. With a strong brand, a focus on innovation, and a commitment to sustainability, UPS is well-positioned for success in the years to come.

So, what are you waiting for? Go ahead and do your own research, and if you're convinced, take the plunge. And remember, investing is a journey, not a destination. Keep learning, keep adapting, and most importantly, keep your eyes on the prize.

And hey, if you found this article helpful, don't forget to share it with your friends and leave a comment below. Let’s keep the conversation going! Cheers!