IBM Stock Price has been a hot topic among investors, analysts, and tech enthusiasts alike. If you’re thinking about diving into the world of stocks, IBM is definitely worth a closer look. This iconic company has been around for over a century, and its stock has seen its fair share of ups and downs. Whether you’re a seasoned investor or just starting out, understanding IBM’s stock price trends can help you make smarter financial decisions.

Imagine this: You’re scrolling through financial news, and IBM keeps popping up in headlines. Why? Because its stock price is constantly moving, reflecting the company’s performance in the ever-changing tech landscape. IBM isn’t just another tech giant; it’s a pioneer that has shaped the industry as we know it today.

But hold up—before you hit the buy button, let’s break down everything you need to know about IBM Stock Price. From historical data to current trends, we’ll cover it all so you can make an informed decision. Stick around, and let’s dive into the world of IBM together!

Read also:Trumps Education Cuts Tariff Talks A Deep Dive Into The Policies That Matter

What is IBM Stock Price All About?

First things first, IBM Stock Price refers to the current market value of one share of IBM’s stock. Think of it like the price tag on a pair of sneakers—except this one keeps changing based on supply and demand. IBM, short for International Business Machines, is one of the oldest and most respected names in the tech world. Its stock is listed on the New York Stock Exchange (NYSE) under the ticker symbol IBM.

Why Should You Care About IBM Stock Price?

Here’s the deal: IBM isn’t just another company. It’s been around since 1911, and over the years, it’s evolved from manufacturing punch card machines to becoming a leader in artificial intelligence, cloud computing, and quantum computing. If you’re into tech or finance, IBM’s stock price is a key indicator of how the tech industry is performing overall.

- IBM’s stock price reflects its financial health and future prospects.

- Investing in IBM can be a smart move if you believe in its long-term potential.

- Understanding IBM’s stock price trends can help you spot opportunities in the market.

Historical Performance of IBM Stock

Let’s take a trip down memory lane and explore IBM’s historical stock performance. Back in the day, IBM was the king of mainframe computers, and its stock price reflected its dominance. But like any tech giant, IBM faced challenges along the way. In the 1990s, the rise of personal computers and the internet forced IBM to adapt, and its stock price took a hit. Fast forward to today, and IBM is once again at the forefront of innovation.

Key Milestones in IBM’s Stock Journey

Here are some key moments in IBM’s stock history:

- In the 1980s, IBM’s stock hit record highs as it dominated the mainframe market.

- In the early 2000s, IBM shifted its focus to software and services, which helped stabilize its stock price.

- More recently, IBM’s acquisition of Red Hat in 2019 marked a major turning point, signaling its commitment to cloud computing.

These milestones show that IBM is not afraid to pivot when necessary, and its stock price often follows suit.

Factors Affecting IBM Stock Price

So, what makes IBM’s stock price go up or down? Like any stock, IBM’s price is influenced by a variety of factors. Let’s break them down:

Read also:Hindi Link 4u Your Ultimate Guide To Hindi Resources

1. Financial Performance

IBM’s quarterly earnings reports play a huge role in determining its stock price. If the company beats analysts’ expectations, its stock price is likely to rise. On the flip side, if IBM misses its targets, investors might start selling their shares, causing the price to drop.

2. Market Trends

The tech industry is constantly evolving, and IBM’s stock price is heavily influenced by broader market trends. For example, the rise of cloud computing and artificial intelligence has been a major driver of IBM’s recent growth.

3. Economic Conditions

Let’s not forget about the economy. Recessions, inflation, and interest rate changes can all impact IBM’s stock price. When the economy is strong, investors are more likely to buy stocks like IBM. But during tough times, they might pull back, causing the price to fall.

Current Trends in IBM Stock Price

As of 2023, IBM’s stock price has been on a bit of a rollercoaster ride. The company’s focus on cloud computing and AI has attracted a lot of attention from investors, but it’s also facing stiff competition from other tech giants like Amazon and Microsoft. Despite the challenges, IBM remains a solid investment option for those who believe in its long-term potential.

Why IBM Stock Price Matters Now More Than Ever

Here’s why IBM’s stock price is worth watching:

- IBM is investing heavily in cutting-edge technologies like quantum computing.

- The company’s cloud business continues to grow, driving revenue and profits.

- IBM’s strong brand and reputation make it a safe bet for long-term investors.

How to Analyze IBM Stock Price

If you’re thinking about investing in IBM, you’ll want to do your homework first. Analyzing IBM’s stock price involves looking at both technical and fundamental factors. Here’s how you can get started:

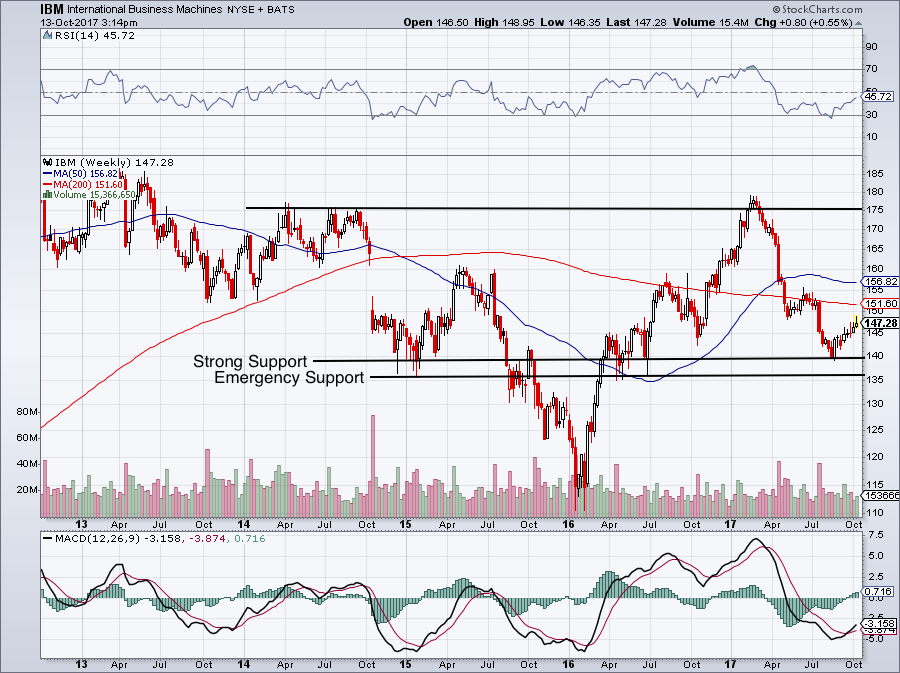

1. Technical Analysis

Technical analysis involves studying charts and patterns to predict future price movements. For example, you might look at IBM’s moving averages or relative strength index (RSI) to gauge whether the stock is overbought or oversold.

2. Fundamental Analysis

Fundamental analysis involves digging into IBM’s financial statements to assess its true value. You’ll want to look at metrics like revenue growth, earnings per share (EPS), and price-to-earnings (P/E) ratio to determine whether IBM’s stock is undervalued or overvalued.

Investing in IBM Stock Price

Now that you know the ins and outs of IBM’s stock price, let’s talk about how to invest in it. Whether you’re a beginner or an experienced investor, there are several ways to get started:

1. Buy IBM Stock Directly

The simplest way to invest in IBM is to buy its stock through a brokerage account. You can do this online in just a few clicks. Just remember to do your research and only invest what you can afford to lose.

2. Use ETFs or Mutual Funds

If you’re not ready to commit to buying individual stocks, you can invest in ETFs or mutual funds that include IBM in their portfolio. This gives you exposure to IBM without putting all your eggs in one basket.

IBM Stock Price Predictions

So, what does the future hold for IBM’s stock price? Analysts are divided on this one. Some believe IBM’s focus on cloud computing and AI will drive its stock price higher, while others are concerned about the competition. One thing’s for sure: IBM’s stock price will continue to be influenced by its ability to innovate and adapt to changing market conditions.

What Analysts Are Saying

Here’s a snapshot of what analysts are saying about IBM’s stock price:

- Some predict IBM’s stock will hit new highs in the next few years.

- Others warn that the company needs to accelerate its growth to stay competitive.

- Overall, the consensus is that IBM remains a solid investment for long-term investors.

IBM Stock Price vs. Competitors

When it comes to tech stocks, IBM isn’t the only player in town. Companies like Amazon, Microsoft, and Google are also vying for dominance in the cloud computing space. So, how does IBM’s stock price stack up against its competitors?

A Closer Look at the Competition

Here’s a quick comparison:

- Amazon: Known for its massive cloud infrastructure, AWS, Amazon’s stock price is often seen as a benchmark for the industry.

- Microsoft: With Azure, Microsoft is a major player in the cloud space, and its stock price reflects that.

- Google: Google Cloud is gaining ground, and its parent company Alphabet’s stock price is on the rise.

IBM may not have the same market cap as these giants, but its focus on enterprise solutions and hybrid cloud makes it a unique player in the market.

Final Thoughts on IBM Stock Price

There you have it—everything you need to know about IBM Stock Price. Whether you’re a long-term investor or just curious about the tech industry, IBM’s stock is worth keeping an eye on. Its historical performance, current trends, and future potential all point to a bright future for the company.

Before we wrap up, here’s a quick recap:

- IBM Stock Price reflects the company’s financial health and market position.

- Factors like financial performance, market trends, and economic conditions influence IBM’s stock price.

- Investing in IBM can be a smart move if you believe in its long-term potential.

So, what are you waiting for? Dive into the world of IBM and see where it takes you. And don’t forget to share your thoughts in the comments below or check out our other articles for more insights!

Table of Contents

- What is IBM Stock Price All About?

- Historical Performance of IBM Stock

- Factors Affecting IBM Stock Price

- Current Trends in IBM Stock Price

- How to Analyze IBM Stock Price

- Investing in IBM Stock Price

- IBM Stock Price Predictions

- IBM Stock Price vs. Competitors

- Final Thoughts on IBM Stock Price